The Rising National Debt Drives Up Long-Term Interest Rates

Last Updated December 12, 2022

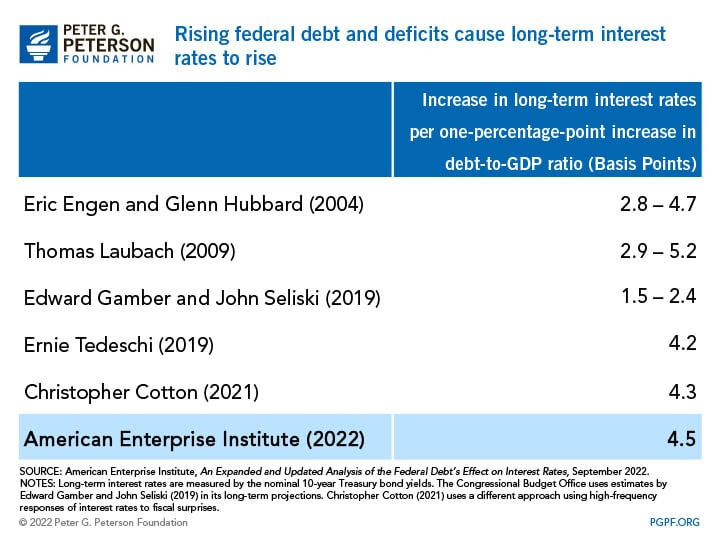

Mounting federal debt can cause interest rates to rise significantly, according to a new report released by the American Enterprise Institute (AEI). The report estimates that a one-percentage-point increase in the federal debt-to-GDP ratio is associated with a 4.5 basis point (one basis point is one hundredth of one percent) increase in the yield on 10-year Treasury notes. By comparison, that is nearly double the 2.5 basis point increase that the Congressional Budget Office (CBO) uses to make its budget and economic projections.

Estimates of the effect of rising debt on interest rates are highly relevant given the growth in the debt-to-GDP ratio expected over the next few decades. Higher interest rates lead to higher interest costs, which put significant pressure on the federal budget, particularly in the context of rising inflation and the Federal Reserve’s countermeasures. The Fed has pushed up short-term interest rates over the past several months and concerns about inflation have boosted long-term rates, adding to the already large and growing component of interest on the federal debt.

What Factors Have Influenced Interest Rates over the Past Two Decades?

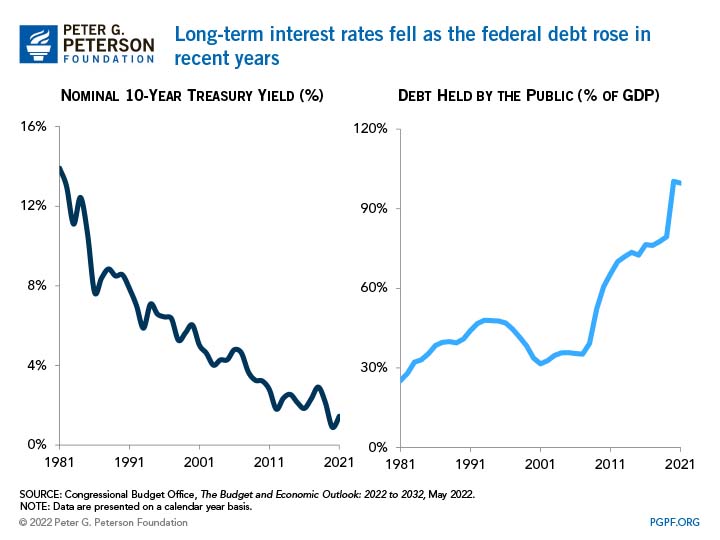

Conventional economic theory holds that a rise in the national debt causes the long-term interest rate to increase as government borrowing crowds out private investment. But since the early 2000s, the long-term interest rate, measured by the nominal 10-year Treasury yield, has generally fallen while the federal debt grew rapidly.

That phenomenon has sparked a debate on the validity of the traditionally accepted relationship between rising debt and interest rates. AEI examines several economic factors that could explain the restraint in rates in recent years. Those include:

- An aging population, which has likely resulted in higher savings rates and reduced spending

- Growing demand for riskless U.S. debt among foreigners

- The Federal Reserve’s monetary policy, which previously included a very low federal funds rate and purchases of longer-term securities (quantitative easing)

- Prior expectations of low inflation

- Slow economic growth and lower consumption growth

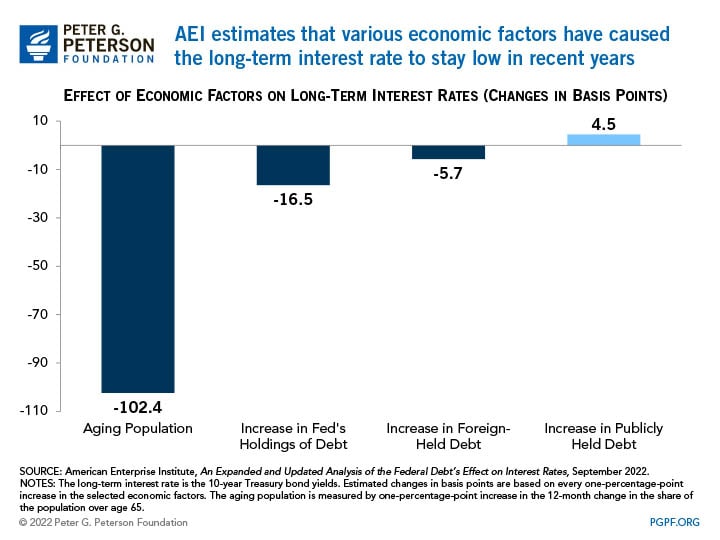

According to AEI, those factors have placed downward pressure on long-term interest rates that have offset the pressure from rising debt. In particular, AEI estimates that a one-percentage-point increase in the Fed’s holdings of Treasury debt decreases long-term interest rates by 16.5 basis points; similarly, such an increase in holdings by foreigners is associated with a decrease of 5.7 basis points. In addition, the aging population (as measured by one-percentage-point increase in the annual change in the share of the population over 65) is associated with a one-percentage-point decrease in long-term interest rates. But such offsetting factors may be diminishing.

What Does a Higher Interest Rate Mean for the Federal Government?

While the downward pressure from various factors have been dominating the effects of rising debt on interest rates, the recent rise in inflation may introduce new challenges for the government. Since 2007, the Treasury has been able to borrow at a relatively low cost due to historically low interest rates since the financial crisis began. But in response to rising inflation, the Federal Reserve has been increasing the federal funds rate and conducting quantitative tightening (selling its assets to reduce the money supply in the economy). AEI projects that the scheduled quantitative tightening announced in May 2022 could raise long-term interest rates as much as 55 basis points by December 2023, holding all else constant.

As interest rates rise, so too will the borrowing costs of the government. According to CBO, the government’s net interest costs will total $66 trillion over the next 30 years, accounting for nearly 40 percent of all revenues by 2052. AEI warns that those costs could be even larger — CBO’s projections incorporate a smaller estimate of the impact of rising debt on long-term interest rates than AEI estimates. Assuming a continued increase in interest rates to 6 percent by 2052, AEI estimates that the debt-to-GDP ratio could equal 235 percent by 2052, compared to CBO’s estimate of 185 percent.

The rising debt and the costs of financing present a significant challenge for America’s future. The government’s spending on financing its debt means that there will be fewer resources for other public needs. A better understanding of how the growing debt and interest costs affect each other is therefore crucial in designing policies that promote a healthier economy.

Image credit: Mark Makela/Getty Images

Further Reading

Long-Term Budget Outlook Leaves No Room for Costly Legislation

As lawmakers consider costly legislation to extend expiring tax provisions this year, CBO’s latest projections serve as a warning that our fiscal outlook is already dangerously unsustainable.

Moody’s Warns Recent Policy Decisions Worsen U.S. Fiscal State, Maintains Negative Outlook Rating

Moody’s says that the United States is in fiscal deterioration, warning that government policy decisions in the near term could contribute to higher interest rates and worsening national debt.

National Debt Would Skyrocket Under TCJA Extension

New analysis released from the nonpartisan CBO shows deficits doubling and debt skyrocketing under a scenario where the expiring provisions of the Tax Cuts and Jobs Act were made permanent.